Condo Insurance in and around Louisville

Here's why you need condo unitowners insurance

Protect your condo the smart way

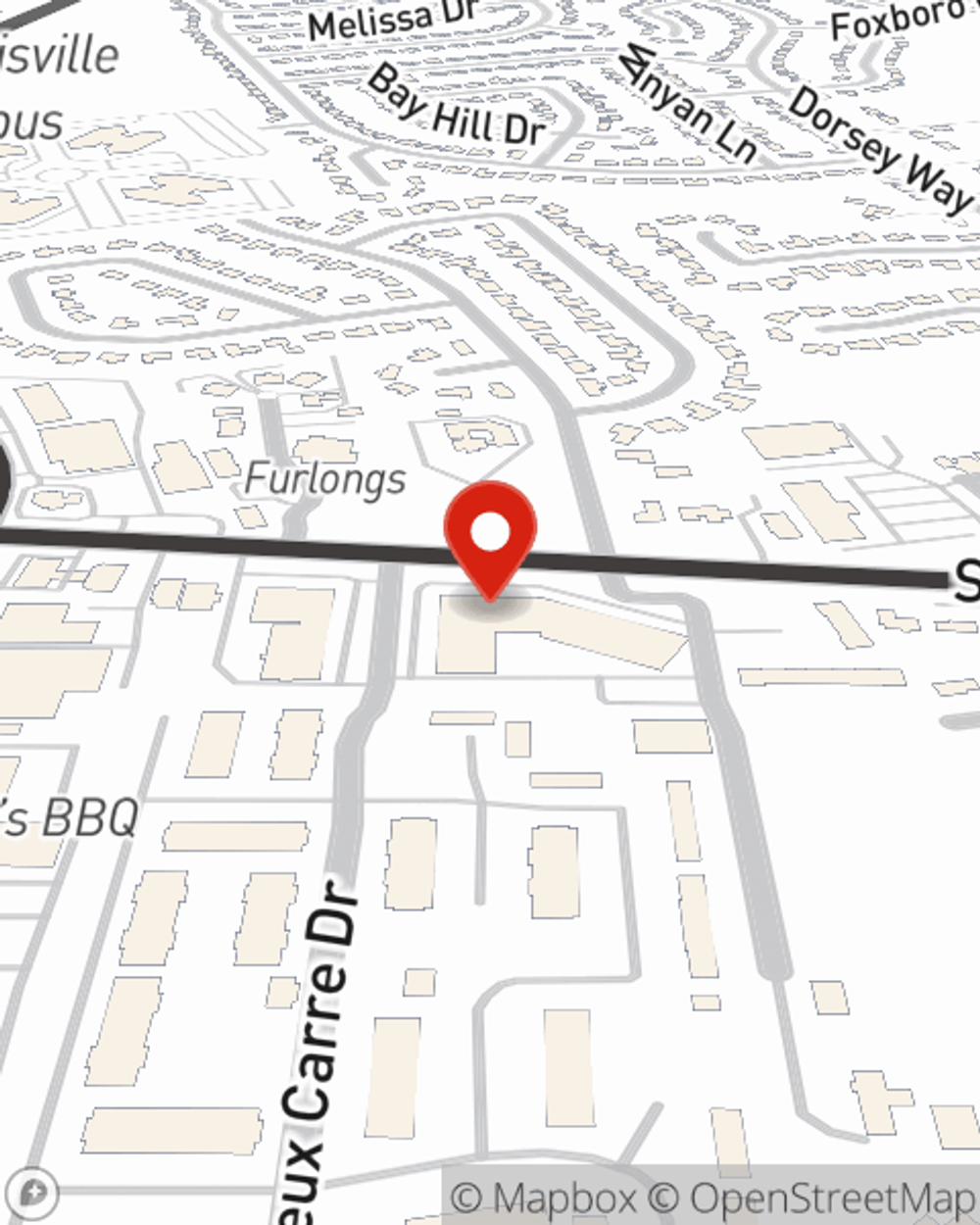

- Louisville

- Fern Creek

- Jeffersontown

- Middletown

- St Matthews

Your Search For Condo Insurance Ends With State Farm

Because your condo is your safe place, there are some key details to consider - size, needed repairs, future needs, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you outstanding coverage options to help meet your needs.

Here's why you need condo unitowners insurance

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

With this protection from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Duane Riley can help inform you of all the various options for you to consider, and will assist you in constructing a terrific policy that's right for you.

Finding the right insurance for your unit is made painless with State Farm. There is no better time than today to get in touch with agent Duane Riley and learn more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Duane at (502) 231-7850 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Duane Riley

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.